Britain's dramatic and unique spatial challenges demand radical answers. The Preston model offers one potential solution for matching both democratic and economic challenges.

An important strand running through many of the recent pieces outlining a tentative political economy of Corbynism is a recognition of the regional.1 This is a positive sign: when Labour last radically reorganised the British economy, during Clement Attlee’s 1945 administration, such an approach was often absent. The programme of nationalisation then carried out – organised along the lines envisaged by Herbert Morrison – was an exercise in intense centralisation, with the setting up of appointed, arms-length, and undemocratic Boards to manage newly nationalised industries. Naturally, this resulted in a serious democratic deficit: one miner, cited by Reuben Kelf-Cohen in his study of the nationalised industries, “described working for the National Coal Board as working for a ghost”.2

As the Labour leadership has rightly recognised, there are compelling democratic reasons to reject this detached, top-down, managerial conceptualisation of socialism which once prevailed in this country. There are also significant spatial reasons to break with this moribund Morrisionian approach. Attempts to engender transformative change and bring about meaningful (p)redistribution of wealth have to be necessarily attentive to the spatial tapestry of unequal development and intense centralisation that increasingly characterises the contemporary political economy of the United Kingdom.

At the outset, it is worth shedding some light on the scale of regional disparities and centralisation that blight the United Kingdom. One of the central, lingering problems we face is simply that of perspective: even when people implicitly recognise that something is wrong, what is often missing isof an awareness of the uniquely unenviable scale of the regional and local inequalities that blight the United Kingdom. The fact, as Philip McCann notes, that

much of the UK resembles East Germany and the Northern Mezzogiorno while the southern parts of England and Scotland more closely resemble the richest parts of Norway, Germany and Austria is likely to come as a surprise to many people. In the post-war period the regions of Eastern Germany have suffered four and a half decades of communism plus a traumatic post-unification economic transition process while the Mezzogiorno regions have suffered from severe governance and institutional problems. Yet, the observation of today’s economic performance indicators suggests that in economic terms the severity of the experiences of the German and Italian regions appears to have been similar to the severity of the experience undergone by many UK regions during the last half century or more.3

The fact that misconceptions abound when looking at the relative performance and prosperity of the UK on an international basis is in many ways a result of the intense centralisation – to be touched upon later – that characterises this nation. Our problems are, as McCann again argues, significantly:

exacerbated by the fact that large sections of the UK media and political circles appear to be largely unaware of where the UK as a whole actually sits in international rankings in terms of economic prosperity… Much of the reason for this is that the UK media and political circles are dominated by the day to day experience of London and its hinterland, and as such, the media and political circles frame discussions of these issues entirely with a London-specific backdrop, one which is not even approximately reflective of the UK as a whole.4

Regional Inequalities

The headline figures tell this story fairly well. The United Kingdom has some of the highest levels of regional inequality of any major European economy,5 and – in contrast to the direction of travel in Belgium, Germany, and Italy6 – historical economic analysis shows that, whilst regional inequality is by no means a new problem, this situation has worsened since 1971.7

Pick almost any economic or social metric and the same picture – of an increasingly decoupling economy, and an increasingly regionally divided nation – reveals itself.

- On Gross Disposable Household Income, regional inequality has risen since 2010: as of 2015, disposable income in London was 32% above the national average.8

- If we look at regional quintiles of income per capita across the EU, we are once again a stark outlier: the UK is the only nation to have regions in all five quintiles. At the NUTS3 level of disaggregation (the smallest geographic area used in Eurostat figures), this degree of inequality grows even further: the NUTS3 area of Inner London has by far the greatest income in the EU, whilst some UK regions have levels of income comparable to the poorest areas of the original Eurozone nations.9

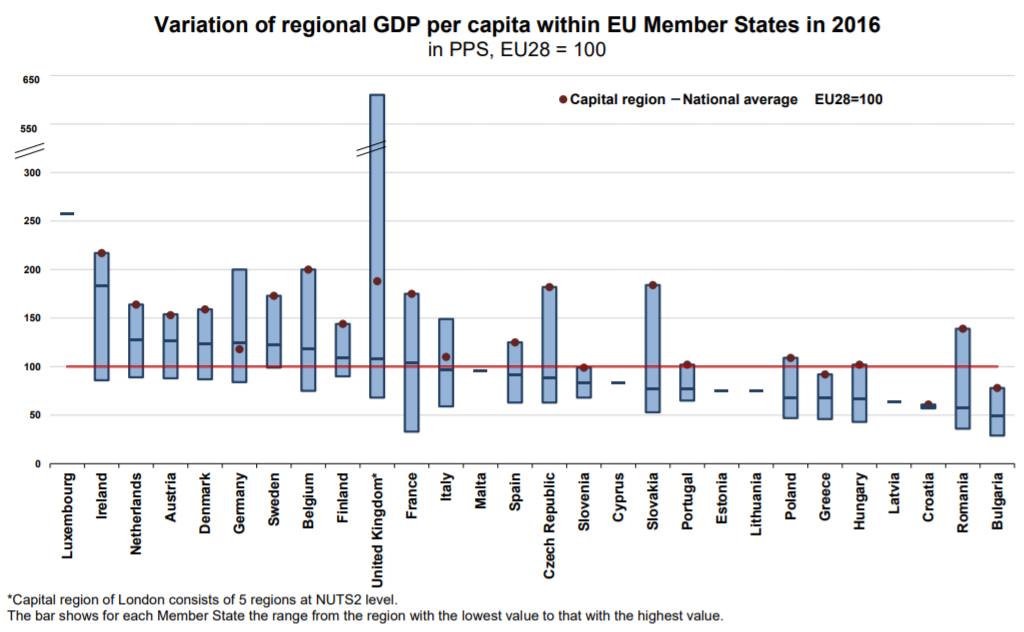

- Work by Eurostat demonstrates this dramatically: as the graph below shows,10 the NUTS2 region of Inner London – West has a GDP per capita 611% of the EU average; this dwarfs all other NUTS2 regions in every other member state by some way.

- On economic output, we have the greatest regional disparities found in Europe: turning to Gross Value Added per worker (a standard measure of productivity), interregional variations are greater in the UK than any other measured economy besides Chile and Mexico.11

These economic disparities – naturally enough – can precipitate or exacerbate wider socioeconomic disparities. A case in point would be male life expectancy: there is a three-year gap between the region with the highest – the South East – and the lowest – the North.12 It is important to be clear here: as the Equality Trust point out, “there appears to be a statistically significant correlation between wealth and male and female life expectancy between regions”.

Though more work needs to be done on this relationship, it is certainly notable – and surprising – in a centralised state with a national healthcare system. Work by both the Office for National Statistics13 and the British Medical Journal has pointed to the way regions – and thus regional inequality – play a role in determining factors such as health: the BMJ in particular argue that the “severe, long term, and recently worsening structural health problem in the geography of England” may require “a more directed regional economic policy”.14 Indeed, even the Government’s own Social Mobility Commission do not mince their words: a 2017 assessment of policies enacted since 1997 concluded, justifiably, that “a new geography of social and economic disadvantage has opened up in the UK.”15

Electoral consequences

This new geography can be seen at multiple scales: the region – and regional inequality – is but one way of looking at the wider issue of inequality across the United Kingdom. The region of London appears like a prosperous paradise when compared to the rest of the country,16 but: that doesn’t mean London itself isn’t wracked by poverty and inequality. Regional inequality is merely a particular spatial manifestation of uneven development.

Naturally enough, these fissures have electoral consequences. In the aftermath of the vote to leave the European Union, former Prime Minister Gordon Brown asserted that “the real division is between those who would support a well-managed globalisation and those who oppose co-ordinated action”.17 Eleven years previously, Tony Blair – somewhat infamously – argued that “I hear people say we have to stop and debate globalisation. You might as well debate whether autumn should follow summer,” celebrating an economic system “unforgiving of frailty.”18

That the growing inequality let loose by Thatcher and accepted by Blair manifested itself particularly strongly through a regional prism should hardly be surprising: the economic model of neoliberalism, and the scale with which it was enforced in the United Kingdom, exacerbated historical regional inequalities, as documented by Geary et. al.19 The problem is that as neoliberalism drove the UK towards city-centric service growth to extract financial profits globally, a replacement for past industrial strategies, or any meaningful alternative regional economic strategy, has not yet been implemented. From a regional perspective, the recent trajectory has been for city-centric growth – inequitably distributed – to run contemparenously with drastic decline and immiseration in peripheral regions.

New Labour’s own approach to regional inequality – the setting up of Regional Development Agencies – was unsurprisingly similar to their more general approach and assumptions vis-à-vis neoliberalism. This approach focused on taxing corporate profits to distribute but made no structural changes to ownership of the economy, dependent on a somewhat naive hope that these temporary fixes would be sustainable long-term. Like much of New Labour’s work, whilst it would be churlish to claim that nothing was achieved whilst in government, a lack of strategic thinking meant any achievements were far from resilient: the incoming Coalition government in 2010 promptly dismantled RDAs on the grounds that they were distorting market forces.20

As such, we are now, as a number of perspicacious commentators are recognising:

once again in a Polanyi moment. The vast disruptive power of markets and globalisation unleashed upon people, communities, and regions now requires a massive ‘re-embedding’ of the economy in society and nature if we are to avoid a catastrophic spiral into fascism and environmental collapse. Decades of ceaselessly expanding market liberalism have sown row upon row of dragon’s teeth; the left must quickly recover the capacity to offer a radically different political economy or reap the consequences.21

The form this re-embedding will take is crucial: no return to the top-down nationalisation of the past, but instead a government committed to serious decentralisation of the state and a concomitant wave of democratic ownership and oversight over the economy.

If we want to look at the aforementioned consequences of regional inequality and extensive market liberalism, Brexit represents a case in point. Tom Hazeldine’s masterful New Left Review piece sketched out the regional nature ofto the spatial voting patterns that led to a leave victory, whilst research by the New Economics Foundation showed similar regional relationships predicting leave preferences: “On average, the Leave vote share was 20 points higher in those places that have experienced the greatest declines in terms of human and economic capital in recent decades.”22 Further econometric analysis from Italo Colantone and Piero Stanig has used data on Chinese imports to convincingly suggest that “geographically concentrated economic distress—driven by the Chinese import shock—led to an increase in Leave support”:23 in other words, support for leave was heightened in areas left out of new patterns of growth created by globalisation. Contrary to Blair’s assertions then, globalisation, even when not directly on the ballot paper, can indeed be debated, with its effects being roundly rejected at the ballot box.

This website has already featured excellent analysis of the spatial dimensions and contradictions of the UK: Daniel Frost is entirely justified in noting that “geographic fixations are nothing new in the history of the Labour Party”, and many of the rather vague references to small towns currently in vogue seem to be mobilised more as a stick to beat Corbynism with than as evidence of serious reflection.

This being true, however, is no reason to ignore the ramifications of regional disenfranchisement with regard to Labour’s nascent institutional turn. Insofar as the Brexit vote represented a rupture from the neoliberal settlement, there are certainly reasons to be optimistic (one ought not make the mistake of delving too far into economics and forgetting the rhetoric and tone of the Leave campaign). Nevertheless, regional inequality doesn’t only augur positively for Labour: research from the aforementioned NEF report shows that since 2005, the Conservatives have increased their share of the vote in small towns from 34.5% to 48.0%, whilst Labour’s support in small towns has remained stable. A worrying trend is the fact that greater relative decline results in worse electoral results for Labour, and comparatively greater success in these areas for the Conservative party.

At such a juncture, reference ought to be made to the successes – both electoral and economic – of the Preston Model: the Labour party, in places where councillors break from the status quo of implementing austerity and questionable redevelopment projects, is undertaking ambitious economic experiments that are gaining success at the ballot box. For both economic and electoral reasons, it is incumbent upon Labour at a local level to start rolling out and joining up many of these disparate alternatives taking places across the country.

Centralisation

This is easier said than done, however, as a result of the gradual defenestration of local government in the United Kingdom. The secondary issue we must deal with in the context of a renewed political economy sensitive to spatial disparities is the centralisation of the UK’s governance structures.

As with regional disparities, the United Kingdom is – regrettably – something of an unfortunate outlier: on every dimension of decentralisation, the UK lags behind the OECD averages.24 To put things plainly, the UK is one of the most centralised nations in the world.25 It was not always so, however:

Time was when Britain had a local and regional banking system, a network of local stock exchanges in addition to the London market, distributed across some 22 cities, a system of local government municipal finance in which the majority of funds were raised and spent locally, a press system based in the country’s major cities, and so on. One by one, these organisations and structures have become rationalised, centralised and controlled from London, often with explicit or implicit state involvement.26

Not only is the UK incredibly centralised, then, but it is also on a historical trajectory of increasing centralisation. In 1910, government expenditure as a percentage of total expenditure was harmoniously balanced: 50% undertaken by local government, 50% by central government.27 By 1990 the share undertaken by central government had reached 72%; as of 2016, 76% of expenditure is undertaken by central government, with only 24% undertaken by local government.28

This can engender problems throughout the wider spatial economy: central governmental spending can have positive and negative multiplier effects across the breadth of the nation, and these effects are often unevenly distributed. The scale of this spending from the centre can often counteract remedial spending intended to generate regional growth. By way of an example, Ron Martin has demonstrated how in the late 1980s:

spending on regional preferential assistance amounted to a mere £617 million, while government spending on defence, fixed capital formation, general industry support, labour market programmes and public procurement totalled more than £24 billion.29

A crude, but nonetheless apposite analogy would be to strike somebody with a car, and duly throw them a pack of plasters as you speed away. How can problems exacerbated by the multiplier effects of highly centralised spending be solved by throwing a few scraps to struggling regions? If the national economic model – service-driven, financialised, asset-obsessed – proves so deleterious to regions, cities, and towns across the nation, the model itself needs to be changed: remedial spending alone cannot plaster over the cracks in good times, let alone bad.

Looking past the absurd reaction to it, and taking into account some of the fair critiques, Labour’s Build it in Britain campaign is therefore certainly worthy of praise – the Labour Party having any industrial strategy whatsoever is a novelty for someone, like myself, born in the 90s – but targeted national procurement alone cannot necessarily solve these specific spatial issues. In Corbyn’s speech announcing the policy, reference was made to the fact that British passport production was awarded to a French firm. Substituting a French firm for a British firm is not a universal panacea: if procurement is sourced from Brighton rather than Bristol, the same problems exist.

This is not to say the policy should not be supported: using the purchasing power of government to stimulate growth is something of a no-brainer. As Larry Elliot rightly points out in the Guardian, “using tax, trade policy, procurement and subsidies to support industry is not really that radical. It is what other countries do.” The key point, however, is that the scale of our regional malaise means we need more besides. An economic and political model more minded to change the fundamentals than simply guard against downturns is likely to be more resilient long-term, as the New Labour years have shown us.

The answers?

Regional inequality and centralisation are not new phenomena, but both have evolved since the imposition of neoliberalism in Britain. This model, as Danny MacKinnon rightly notes,

is underpinned by debt and the housing market, with rising house prices enabling the release of equity to support consumption, supported by the liberalisation of financial markets and low interest rates. This growth model has itself fuelled regional disparities, favouring the south of England where housing markets have been far more buoyant, thus supporting higher levels of consumer spending.30

To meaningfully tackle ballooning regional inequality is thus to confront neoliberalism: we need not, and must not, shy away from this task. A nascent intellectual infrastructure31 is evolving to provide answers to these questions (New Socialist itself being a case in point), but we come from a position of structural weakness.

As such, strategies that we implement – in this case focused towards resetting our regional malaise – need to be feasible and effective. What follows is a necessarily rough sketching out of what an equitable strategy for a spatial economy for the many might look like in practice. A point worth stressing is that these are far from definitive solutions: indeed, the viability of any transformative change in our regions must ultimately be informed by the specifics of towns and cities, not rolled-out from the centre as a one-size-fits-all approach. That said, the ideas outlined below are certainly applicable throughout much of the country, and represent – if nothing else – a discursive starting point in thinking through a regional economic revival that is, at its core, democratic: removing power from the centre and dispersing it meaningfully to citizens spread throughout the nation.

Regional banking

Without doubt, we need to address the role of finance within the wider economy. Financialisation is extractive and speculative, increasingly dependent on unfettered mobility and the ceaseless innovation in financial instruments. In a world of capital account liberalisation and all manner of complex options, synthetics, and derivatives, capital – through finance – is increasingly able to avoid directly investing in what for many people is the “real or productive” economy, outside of the core high-value firms that make up much of our economic growth but little of labour’s wealth.32 Figures on bank lending lay bare this trend: in 1950, 65% of bank lending was directed towards industry; by 2010, it had fallen to 15%.33 Simultaneously, lending to financial companies to increasingly maintain profits from these firms’ supply chains, control and supply of commodities, and constant need for capital, has increased from 10% to 38%.34

This sorry state of affairs is not a foregone conclusion: in Germany, the corresponding figure for industry lending in 2010 was 45%. Crucially, this represents more than just its wider industrial base but also its rather different banking structure: there, local savings banks – Sparkassen – are geographically restricted in terms of both receiving deposits and – crucially – lending to businesses.

Marianne Sensier has written an impressive paper explaining how a similar model of regional banking might be realised: more generally across the UK; specifically, in the Greater Manchester area. Precisely because of the centralised nature of the UK, with finance focused in the City of London, firms in peripheral locations often face precipitous funding gaps.

Sensier’s suggestion is to investigate forming Regional Community Banks.: Tthese institutions would be owned by their customers, with every citizen residing in the region eligible to purchase one share – for a nominal price of £15 – in order to become a member. The Community Savings Bank Association estimates that a newly formed bank requires around £20 million in start-up capital in the first five years; this need not be a problem, particularly – as Sensier points out – if government money replacing European Regional Development Funding is utilised to capitalise these regional banks.

Elsewhere – on this very site – John Marlow has written a comprehensive investigation of Labour’s plans for a National Investment Bank. Echoing the points made at the opening of this essay, he argues that:

We should not envision a monolithic, top-down institution, but a network – or federation – of local banks embedded in the municipalities they serve.

This is eminently possible, particularly with a Regional Community Banking model, and ties into the wider potentials of harnessing the effects of local economic multipliers, rather than running the state from the centre without fully considering the multiplier effects of spending directed from the centre. “In and against the state” must be more than just a phrase in the formation of a 21st century socialism: democratisation and decentralisation will be crucial in restructuring an economy that is both more resilient and redistributive.

Marlow suggests that Labour ought to nationalise branches set to close on local high -streets, keeping them open for public interest reasons. We should go a step further: borrowing from the NEF’s recent Co-Operatives Unleashed report, we should implement a workers’ Right-To-Own policy: if a private bank chooses to shut down a high-street branch, the employees should get the first refusal to keep it open as a local co-operative branch of the aforementioned Regional Community Banks.

This strikes me as a highly effective policy proposal. Right-wing hysterics about the crowding-out of the private sector would be quietened when the decision to close a branch lies with the private company; furthermore, this Right-To-Own ties into a wider agenda of socialising and democratising the economy. Indeed, NEF’s earlier research on Local Multipliers justifies such an intervention. Retaining local cashpoints and bank branches is integral in ensuring money is spent in local areas: as they note, “the removal of the final cashpoint or Post Office facility can be just as devastating to the local economy as the high-profile closure of a factory or coalmine.”35

At Conference this year, Labour committed to banning high street bank closures. To me, this appears to be the wrong approach: both in specific and general terms, are our aims merely to mitigate against the worst excesses and practices of the current economic model, or to seek to implement something better and qualitatively different? Rather than simply requiring private banks keep their branches open, a system of regional banks and local co-operatively run branches ties in to a wider imperative towards both regenerating local economies and insulating them from the effects of the corporate finance sector. We require boldness, not timidity, if our intention is to fundamentally reshape Britain’s political economy.

Foundational economy

Of course, a National Investment Bank and a series of Regional Community Banks will be of little significance if the firms they lend to pay a pittance to their workers, or hastily relocate to cheaper locales. Regional banking with national standards and conditionalities seems a sensible route to take: a situation whereby regions simply compete with one another to offer more favourable funding is bound to be deleterious to any progressive economic transformation.

The aim of this has to be directly providing investment for opportunities rather than simply reducing the supply of investment to the ephemeral and hyper-competitive concept of “attracting inward investment” which has been so prevalent in recent decades. In a roundabout way, this latter model helped catalyse some of the more interesting experiments in local wealth building that are taking place currently. The background for the birth of the Preston Model was a £700m redevelopment project, cancelled by developers and investors in 2011 as a result of the preceding global financial crisis.36 If the Preston Model itself suggests routes to a more resilient and collaborative form of regional development, the forestalled precursor should act as a cautionary tale. Relying on, and competing to attract, inward investment is far from a solution for Britain’s struggling localities and regions.

A model obsessively seeking inward investment logically leads to the absurd spectacle of redacted documents: local citizens forbidden from even knowing the scale of hand-outs their municipalities are offering up to large corporations. Such a model of development swiftly moves from the economically incoherent to the functionally undemocratic. This is not a model of economic or regional development we should be advocating: in Preston, anxious investors pulled out; in other municipalities, negotiations behind closed doors make it clear that any inward investment comes at a cost.

What’s more, there is often a startling naiveté in these proposals. If a company is willing to relocate to a particular locality offering preferential treatment, there is no reason it won’t do the exact same when an even cheaper locale presents itself. The NEF draw attention to Dyson relocating from Gloucestershire to Malaysia; a recent London Review of Books piece showed exactly the same dynamic when Cadbury moved from Somerdale to Skarbimierz.

When periphery regions are particularly vulnerable to this dynamic, perhaps – as the NEF suggest – we need to adjust our thinking. In their recent Manifesto for Towns, they urge a renewed focus on the foundational economy: as they rightly argue, “those parts of the economy on which we all rely every day, and in which much of the workforce is employed – exists in almost equal relative measure in towns as much as in cities.” The relentless obsession with attracting inward investment appears somewhat myopic when we consider the scale and universality of the foundational economy, and: the NEF are entirely right in boldly stating that “the ‘mundane’, or ‘foundational’, sectors of the economy matter just as much, if not more than, the high value added, high technology sectors.”

Indeed, 2013’s jointly penned Manifesto for the Foundational Economy demonstrates clearly the scale of which we are talking: consisting of utilities in the broadest sense (retail banking alongside water and telecoms); the retail component of supermarkets and petrol infrastructure; railways, sewers, and fibre cables; and labour-intensive activities in care and education, some 40% of the UK workforce are employed in sectors that make up the foundational economy.

As the NEF point out: “the chances for improvement are universal – the most economically developed cities and the most ‘left-behind’ towns all have a foundational economy.” We need not reinvent the wheel in revitalising local economies – rather than competing to attract footloose corporations, a focus on improving conditions in the foundational economy is certain to have a virtuous effect up and down the country. This requires an institutional as well as policy change: the foundational economy manifesto is rightly critical of the timidity of ‘corporate social responsibility’. We need to be bold: the cogent point about the work that makes up the foundational economy – utilities, retail, care – is that, unlike manufacturing, it cannot easily be offshored. A real living wage represents a sensible starting point here: a progressive national economic transformation is barely conceivable in a world of low-wage, insecure work, let alone regional redevelopment. It is eminently possible to democratise and decentralise – providing support to co-ops and implementing alternative models of public ownership – whilst improving standards in the foundational economy. Indeed, it is something of a necessity.

This focus on the foundational is an approach that can be usefully tied in to already existing Labour policies. As things stand, the last Labour Party manifesto promised to implement a 1:20 pay ratio, in both the public sector, and for companies bidding for public contracts. There is no reason that this proposal couldn’t be widened out, with Regional Community Bank or National Investment Bank funding being dependent on these criteria, as well as demanding a more generalised commitment to good practice regarding workers’ rights, collective bargaining, and union representation in the foundational economy. Such a policy is again politically powerful: this ensures that the problem outlined at the beginning of this section – Regional and National Investment Banks propping up unscrupulous employers – is avoided, and instead a structural incentive to increase the rights of workers is baked-in to a publicly-owned financing environment.

Autonomous, functional co-operatives and financially viable investment banks cannot simply be cut out of existence. Genuinely publicly run utilities – owned by, not managed for, the people – cannot simply be privatised at a loss. This would represent the centralised state stepping back in many areas, but this is no bad thing: not only does grounding institutions in local communities make them more resilient; it also ensures that large-scale Conservative legislation will find it much harder to euphemistically reorganise large swathes of the economy.

Community wealth building

Of course, all of the above represents little more than an application of the principles of the Community Wealth Building projects already being directed towards specific spatial and macroeconomic problems in the UK and beyond.37 Labour has formed its own Community Wealth Unit, and the on-the-ground work of organisations like the Centre for Local Economic Strategies and The Democracy Collaborative demonstrates the viability of an approach that prioritises locking-in local wealth over allowing an extractive economic model to profit in areas suffering from impoverishment.

Community wealth building encompasses a number of strategies – everything from altering the procurement practices of anchor institutions to catalysing co-operatives and community land trusts – but at its core is a commitment to a more democratic ownership of capital: not blunt, Trumpian protectionism, as some critics like to suggest,38 but changes in ownership utilised to revitalise local areas and thus protect citizens from cyclical crises and extractive economic practices. If regional banking offers a tentative route towards achieving the former, focusing on the foundational economy – raising standards but also altering ownership models – ought to help redress the problems of the latter.

A broader conceptualisation of wealth itself – plentiful public spaces, bike lanes, clean air, good public transport – seems a necessary corollary of this approach, not least because the democratic ownership and management of local economies will surely minimise the myopic focus on maximising quarterly shareholder value and extracting footloose capital at the whims of the market. What we might approximate this approach as could be a Crosland-ite conception of the public good without discarding a commitment to genuinely democratic ownership of the economy: the latter, quite fundamentally, prefigures the realisation of the former.

Conclusion

Labour’s recently released party political broadcast, We’re Rebuilding Britain, appears to tackle many of these points head-on: it is, as Stephen Bush of the other NS puts it, “laser-targeted at small towns”. Cognisance of the wider points raised in this piece is made clear early on: deindustrialisation and decline is figured not just as the result of austerity, but of a wider economic model stretching back decades. These are encouraging signs. It is crucial, nevertheless, that a desire to promote economic regeneration is not driven solely from the centre: economic democracy is key to ensuring these policies are effective, responsive, and legitimate

History can help us here. In the late 1920s, a Labour government tried desperately to maintain what was then economic orthodoxy: keeping Britain on the Gold Standard. Eventually, a National Government was instigated: by 1931, Britain had unilaterally abandoned the Gold Standard. A shocked Sidney Webb, perhaps the preeminent father figure of the Fabian movement, famously complained that “Nobody told us we could do that.”39 Looking back on the Blair years, one can’t help but think of Shelley’s poem ‘Ozymandias’: for all of the talk from some quarters about the good that was done by New Labour, the fact of the matter is that “nothing besides remains.”

We would be foolish to repeat these mistakes – to assume advances stemming from the centre can be maintained when we lose power; to play by the rules of a game our opponents ignore at will. We need to have the bravery and radicalism to decentre the skewed British economy – this is the only way that a regional economic strategy can actually live on past the Corbyn government. This requires serious, meaningful decentralisation. Labour’s plans to relocate parts of the Bank of England to Birmingham – decentring financial management and breaking up the Treasury-City nexus – represent a good start, but we need more beyond this.

John McDonnell has written before on this site that when we go into government, we go into government together. This has to be translated into a serious commitment to decentralisation. – Preston is rightly celebrated, but there is much going on in localities up and down the country that is innovative and inspiring. More could be done by Labour councils already, but the hoarding of power at Westminster certainly limits the scope and scale of any transformation that can be undertaken whilst the Conservatives rule.

A Thatcherism of the left – uncompromisingly changing Britain’s political economy for fifty years, not five or ten – can only be achieved if winning power in the centre acts as a prerequisite for dispersing power around the country. Tackling the ownership of capital to catalyse community wealth building, focusing on the foundational economy and raising standards across the land, and transforming the way finance functions in the UK: this – and much more – is needed to bring about the change we want to see. As the earlier parts of this piece demonstrated, we come from a deleterious position. This provides all the more impetus to get things right when we take power.

-

See The Institutional Turn: Labour’s new political economy by Martin O’Neill and Joe Guinan for Renewal; The Corbyn Project by Robin Blackburn for New Left Review; and Full Corbynism: Constructing a new left Political Economy beyond Neoliberalism by Joe Guinan and Thomas M. Hanna for New Socialist ↩

-

Reuben Kelf-Cohen. 1973. British Nationalisation 1945-1973. London: The Macmillan Press, p. 29 ↩

-

Philip McCann. 2016. The UK Regional–National Economic Problem: Geography, globalisation and governance. Oxford: Routledge, p. 66) ↩

-

McCann, 2016, p. xxvii ↩

-

See Regional inequality, regional policy and progressive regionalism by Danny MacKinnon ↩

-

See Spatially Rebalancing the UK Economy: Towards a New Policy Model? ↩

-

See What happened to regional inequality in Britain in the twentieth century? ↩

-

See NIESR’s GE Briefing Paper No. 6: Regional Inequality in Household Incomes In The UK ↩

-

See The Economics of UK Constitutional Change: Introduction ↩

-

See this Eurostat news release from February 2018, 2018: Regional GDP per capita ranged from 29% to 611% of the EU average in 2016 ↩

-

McCann, 2016, p. 53 ↩

-

See The Equality Trust’s report, A Divided Britain? Inequality Within and Between the Regions ↩

-

See this ONS statistical bulletin: Life Expectancy at Birth and at Age 65 by Local Areas in the United Kingdom: 2006-08 to 2010-12 ↩

-

See this research paper from the BMJ: Trends in mortality from 1965 to 2008 across the English north-south divide: comparative observational study ↩

-

See the Social Mobility Commission’s report Time For Change: An Assessment of Government Policies on Social Mobility 1997-2017 ↩

-

See this Guardian article: Most capital cities are well off, but London is like another country ↩

-

From Leaders must make the case for globalisation, in the Financial Times ↩

-

See What happened to regional inequality in Britain in the twentieth century? ↩

-

See Spatially Rebalancing the UK Economy: Towards a New Policy Model? ↩

-

See Polanyi Against the Whirlwind by Joe Guinan and Thomas M. Hanna for Renewal ↩

-

Cities and Towns: The 2017 General Election and the Social Divisions of Place ↩

-

See this working paper by the OECD Economics Department: Reducing regional disparities in productivity in the United Kingdom ↩

-

See Devolution: a road map by Patrick Diamond and Jonathan Carr-West ↩

-

From Spatially Rebalancing the UK Economy: Towards a New Policy Model? ↩

-

Cedric Sandford. 1984. Economics of Public Finance: An Economic Analysis of Government Expenditure and Revenue in the United Kingdom (3rd Edition ed.). Oxford: Pergamon Press, p. 30 ↩

-

OECD. Table 5: Consolidated government expenditure as percentage of total general government expenditure. Retrieved from OECD Fiscal Decentralisation Database. ↩

-

From Spatially Rebalancing the UK Economy: Towards a New Policy Model? ↩

-

See Regional inequality, regional policy and progressive regionalism by Danny MacKinnon ↩

-

See The making of a movement: who’s shaping Corbynism? by Christine Berry ↩

-

See Grace Blakeley’s The cost of Britain’s “bargain basement” model for the New Statesman. For an alternative view on the disconnect between finance and the productive economy, see Sahil Dutta’s recent New Socialist piece, Servants of Industry? Getting Financialisation Wrong ↩

-

From Spatially Rebalancing the UK Economy: Towards a New Policy Model? ↩

-

ibid. ↩

-

From Plugging the Leaks: Making the most of every pound that enters your local economy ↩

-

See In 2011 Preston hit rock bottom. Then it took back control by Aditya Chakrabortty for The Guardian ↩

-

See Hettie O’Brien’s work on alternative municipal models of ownership in Spain: Who Owns The City? ↩

-

See, for example, Protectionism is protectionism, whether it’s Trump or in Trumpington by Paul Swinney at the Centre for Cities ↩

-

See End of an Epoch: Britain’s Withdrawal from the Gold Standard by Michael Kitson ↩