The Omicron Covid variant has sparked fresh concerns about the economy. Less than a month ago, the Bank of England was threatening to raise interest rates in order to choke off inflation – a move that would raise unemployment and hit workers’ incomes. But now, it seems, the Bank is backing off. In the midst of ongoing debates about how much inflation to tolerate, it is important to remember the political question at the heart of monetary policy: who benefits – the asset poor or the asset rich?

In recent years central banks have transformed into something very different to the ‘inflation hawks’ of yore. Equipped with a ‘public mission’, expansive new powers, and a growing ability to conduct world-class research, central banks are perhaps the pre-eminent public institutions in the world today. None of this has helped the Bank of England, which has recently appeared torn over whether or not to raise interest rates in an effort to combat inflationary pressures. Investors howled when in November Governor Andrew Bailey announced that the Bank would not be raising its historically low policy rate after having previously signalled that action was inevitable. Now, new fears have arisen among central bankers that the Omicron Covid variant will wreak new havoc across economies. How central banks react to strained markets remains to be seen. The traditional view that balances growth against inflation is significantly outdated. Since at least the financial crash of 2008, central banks have been doing far more than targetting inflation. Instead, we can think of central banks’ actions as primarily influencing asset prices. This is because, as some far-sighted but relatively mainstream economists like Perry Mehrling argue, if assets can’t be borrowed against, financial institutions can’t raise liquidity (that is, cash) to meet upcoming payments on outstanding debt. Central banks therefore have to reconcile short-term demand for cash with long-term asset prices. And assets are always political because they raise the question of ownership. By making markets in assets, central banks are unavoidably political.

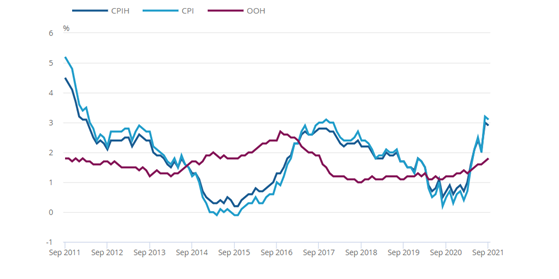

Take the Bank of England. Its stated mission is to ‘promote the good of the people of the United Kingdom by maintaining monetary and financial stability.’ That may seem uncontroversial enough, but it’s important to note the distinctly moral and political dimensions of that mission (the Bank’s former Governor, Mark Carney, took to emphasising this mission in the post-crisis years when the Bank’s remit was expanded to help it pre-empt and combat future financial crises). How is the ‘public good’ conceived, measured and acted upon in the Bank’s eyes? Policy makers at central banks don’t like fanciful political language: they like to have simple targets – preferably one target – against which their performance can be measured. Hence the centrality to most central bank mandates of an inflation target. The Bank of England’s target is 2% annual inflation as measured by the UK Consumer Price Index (CPI). But contrary to what the world of financial journalism and much academic research suggests, that doesn’t mean the Bank is only interested in inflation.

Source: Office for National Statistics

Rather, I argue, the Bank attempts to optimise the performance of a range of assets within limits imposed by a 2% inflation target. The political and moral question, then, is which assets— and, we might add, who owns them? While central banks often frame their actions in an ideology of disinterested macroeconomic stabilisation, they achieve the latter only by optimising the performance of specific assets that are held and traded disproportionately by the wealthy. Central banks came to the view over the course of the 1970s to 1990s that the performance of national economies was determined not by the government’s macroeconomic policy, but by long-run ‘structural’ economic factors – things like demographics, labour supply and flexibility, business investment, and productivity. In this view, what central bankers could do was smooth the path of the economy towards its equilibrium and optimal point. Interest rate policy – that is, balancing the demand for central bank reserves with supply– was eventually hit upon as the way in which to do this. In the short run, the central bank could help the economy on the path towards its optimal state – not by changing fundamentals, but by speeding up its natural tendencies towards that state. If that sounds counterintuitive, that’s because it was – it ran counter to post-war Keynesian economic thinking. Strict models that assumed rational agency, transitory price distortions in the form of exogenous ‘shocks’, and long-run equilibrium were not entirely replaced after the crisis, but adjusted and supplemented with qualitative data – in other words, the Bank started talking to regional British businesses more. It took on board what they told it and also reached out to them to try to explain its view of the future and to keep them on board.

Long gone are the days when the Bank was little more than the representative of the City in the State. Instead, the Bank has made a significant contribution to the endurance and legitimacy of Britain’s underlying state project. That state project incorporates UK business (in the broad, and sometimes fractious, sense) and British homeowners, in particular. Particularly since the financial crisis, the Bank has monitored, interacted with, and worked to ‘promote the good’ not of some abstract economic system, but of specific social groups: by ensuring the supply of liquidity to asset markets, investors have been able to recover their balance sheet positions. As long as investors can borrow today against their stock of assets, they can survive to trade another day. Shadow banks, pensions funds and hedge funds alike all benefit. Moreover, by generating liquidity in this way, a ripple effect drives up prices for other assets including, in particular, mortgage securities. It is this effect that has stimulated global housing markets since the crash. In addition to conventional policy, the Bank has used Quantitative Easing (QE) – through which it creates new reserves, purchases financial securities (particularly government debt) and deposits these reserves in financial institutions’ accounts – as a way to forge wider financial markets. The short-term effect of this is supposedly to stimulate lending by supplying financial institutions with cash. More significantly, the Bank uses this policy to make markets – ensuring there is always a purchaser of assets and keeping the prices of said assets high.

In the postcrisis era, the Bank has combined low interest rates with high asset prices and market making activities of the kind described above. There are other means too by which it has supported specific sectors. When the Brexit vote hit the UK economy in 2016, the Bank was worried that financial capital outflows would cause a crash in internationally exposed sectors. One such example is the UK’s commercial property sector, which is heavily concentrated in London and reliant on footloose international financing. No sector is more emblematic of the UK’s internationalised, rentierised, and highly regionally unequal economic model than its commercial property sector. While the Bank would plead it can do little to change the ‘economic fundamentals’ that determine this preponderance of rent-seeking capital, it acted hastily to shore up this market following the Brexit vote — cutting banks’ countercyclical capital buffer in order to make sure additional lending was available for the sector in the face of capital movements in 2016. It should come as little surprise that around this time, the Bank was engaged in consultation with the sector’s representatives via its Commercial Property Forum – whose leading lights were proposing policy measures remarkably similar to those eventually adopted by the Bank.

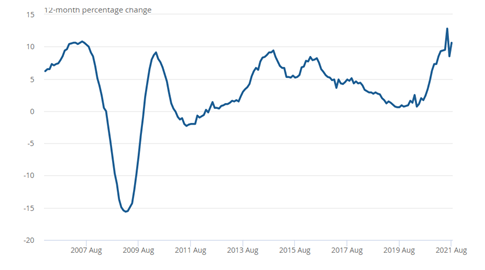

Source: ONS

In a broader view, the UK’s state project – that is, the deep purpose of UK state policy – has revolved in recent years around securing (in political economist Matthew Watson’s phrase) legitimacy through accumulation.1 The historic bloc of social class layers who are catered to through this state project consists of rent seeking big business in sectors like privatised energy and public services, commercial and residential construction, and mortgage holders and property owners. This bloc is not altogether cohesive. Particularly around Brexit, some cracks have appeared in it – with some businesses and older property owners being attracted to the deregulation and closed borders promised by Brexit. The Bank’s unique contribution to the legitimacy of this state project has been to unnaturally prolong its existence by supporting asset values in key markets – housing, construction, and privatised public services key among them. As dysfunctional as the UK’s political economy has become in recent years, it would have been far worse without the Bank.

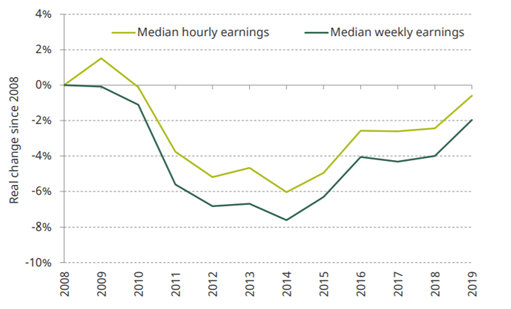

Source: IFS

This brings us to the Bank’s recent mixed messaging around raising interest rates. A small increase in the official policy rate would make little difference to financial markets on its own. Indeed, the complaints of investors voiced in recent months relate mostly to marginal shifts in portfolios. As has been widely argued, a model premised on curbing inflation by constraining demand for bank lending won’t do anything to resolve supply constraints.

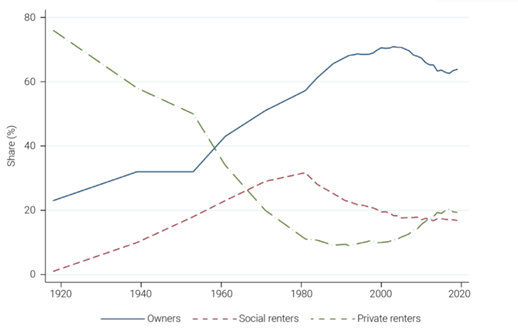

Central banks are technically correct that their mandates demand that they raise interest rates when inflation is above target. But what will force their hands is not ultimately the wording of their mandates, but the philosophy on which their mandates are premised and the power relations they give voice to. That philosophy, as we have seen, says that ‘real’ structural factors will determine the performance of the economy in the long run. A rate hike – squashing an already uneven and unjust recovery from Covid – would be a tacit admission that supply constraints are in fact permanent; that the global economy post-Covid is not what it once was; and that workers must ultimately pay the price of adjustment. The post-crisis era has shown that central banks can support markets in financial assets, largely to the benefit of wealthier sections of society. But, despite this de facto expansion of central bank activism, many in the profession still insist that – when it comes to helping workers by tolerating inflation – their powers are structurally constrained. There is an underlying monetary Malthussianism to this position. Given ‘fixed’ constraints like low ‘real’ interest rates, demographic ageing, labour supply, and productivity growth, ‘artificial’ stimulus will only result in overheating and inflation. Too much employment growth threatens price stability in the final instance. This is the logical conclusion implicit in the Bank’s worldview. The contradiction is that a rate hike would hit mortgage holders – always the most tenuously incorporated beneficiaries of the UK’s economic model, but also its mass base. This dilemma threatens to further undermine the legitimacy of the UK’s struggling state project. The quandary facing central bankers today is a political rather than technical one. Because of central banks’ commitment to asset prices, mortgage markets have continued to boom for over a decade. But workers’ income has stagnated.

Reducing demand in the economy ultimately hits employment. Indeed, the Bank’s inflation targeting regime has a coercive core – it targets workers in the final instance. But since 2008, the lonely hour of the final instance has never arrived. This at its heart was because a weak labour movement couldn’t reassert itself during the recovery from the crash. Inflation remained low even as employment levels recovered. Legitimacy was secured by interpellating a narrowing layer of workers as homeowners and identifying their interests with low mortgage rates and rising house prices. Yet since the crash homeownership rates have been declining. Wages have still not recovered from the crash. Any move by the Bank to raise rates risks finally fracturing the social bloc on which the UK state project relies. Don’t be surprised, then, if changes come slowly and with eventual reversal. While market-based inflation hawks – particularly creditors who fear the effect of inflation on the value of the debts they hope to collect – call for a central bank induced recession to ‘bring things back into balance’, a slowdown may already be occurring, forcing macroeconomic policy to once again step in as the private sector contracts. This won’t happen because central bankers realise they need to ‘help out’ workers in the midst of yet another spike in the pandemic, but because without action to help asset prices, the legitimacy of the whole system could come under threat. Indeed, Deputy Governor Ben Broadbent recently voiced concerns about the ‘risks’ of rising wage costs as workers demand compensation for rising living standards.

Source: Brookings Institute

There could be alternatives. Some have proposed changes to central bank mandates – particularly around targetting assets for green investment. A revival of progressive fiscal policy – backed by direct monetary financing (already a matter of some pre-Covid interest) – is the obvious way forward. Some limited and unsatisfactory form of this – no doubt benefiting capital rather than labour – is perhaps even likely. But it will require at the very least a temporary suspension of the Bank’s philosophy – ultimately constructed in the course of the assault on the labour movement in the 1980s – that investment and consumer demand (on which employment relies) must always be brought back into line with ‘real’ factors (whatever the cost to workers). This moral rationalisation for the historical assault on workers’ income can no longer be sustained if mortgage holders and homeowners – the social base of UK state project legitimacy – are also to be kept afloat. In that contradictory suspension – which would amount to a temporary tolerance of higher inflation and higher state spending – opportunities for working class organising may lie. It was central bankers who in the late 1970s and 1980s created the macroeconomic conditions for the defeat of the labour movements of the global north. With ‘militant’ unions’ wage demands supposedly setting off a wage-price spiral in the 1970s, governments set out to crush the unions in order to restore social order. Central banks like the US Federal Reserve and the Bank of England raised interest rates to historic highs, which curbed demand and raised unemployment. With labour markets slackened by recession, governments were able to beat the unions and enter a new golden age of uninhibited capital accumulation known as the Great Moderation. Today, mired in the contradictions of a social order they helped create, it could once again be central banks that – albeit unwittingly – give an opening to labour organising. If they are unable to raise interest rates because of the social and political costs to mortgage holders, it may still ultimately be workers who seize the initiative.

-

Matthew Watson. 2005. Foundations of International Political Economy . London: Bloomsbury. p. 181 ↩